Motor traders run some of the most successful businesses. They can be categorized as either wholesale or retail, and they deal with both new and used vehicles. Others will repair vehicles on behalf of customers who need MOTs or are looking for a service in-between. It is important to get traders insurance in any of these instances.

Wholesale motor traders buy large quantities of cars from manufacturers in bulk, then sell them to retailers who resell them to the public. Retailers purchase individual cars directly from the public or other retailers, then sell them to customers. Repair garages are an important service when someone has a breakdown or accident in a car they have bought and need to have it fixed as soon as possible. This may be because they need it to commute to work or wish to take it on holiday. Reliability will particularly be required if traveling long distances.

There are many types of motor trade businesses, but they all have one thing in common – they need insurance. Insurance is vital for any business, but it is especially important for businesses that deal with vehicles. This is because there is a higher risk of accidents and damage to vehicles.

There are many different types of motor trade insurance policies available, and it can be difficult to choose the right one. The type of policy you need will depend on the nature of your business. For example, if you repair vehicles, you will need a different policy than if you sell them.

When choosing a policy, it is important to consider the level of cover you need. You should also think about the excess you are willing to pay. The excess is the amount of money you will have to pay if you make a claim.

It is also important to shop around and compare different policies before you buy. This way, you can be sure you are getting the best deal.

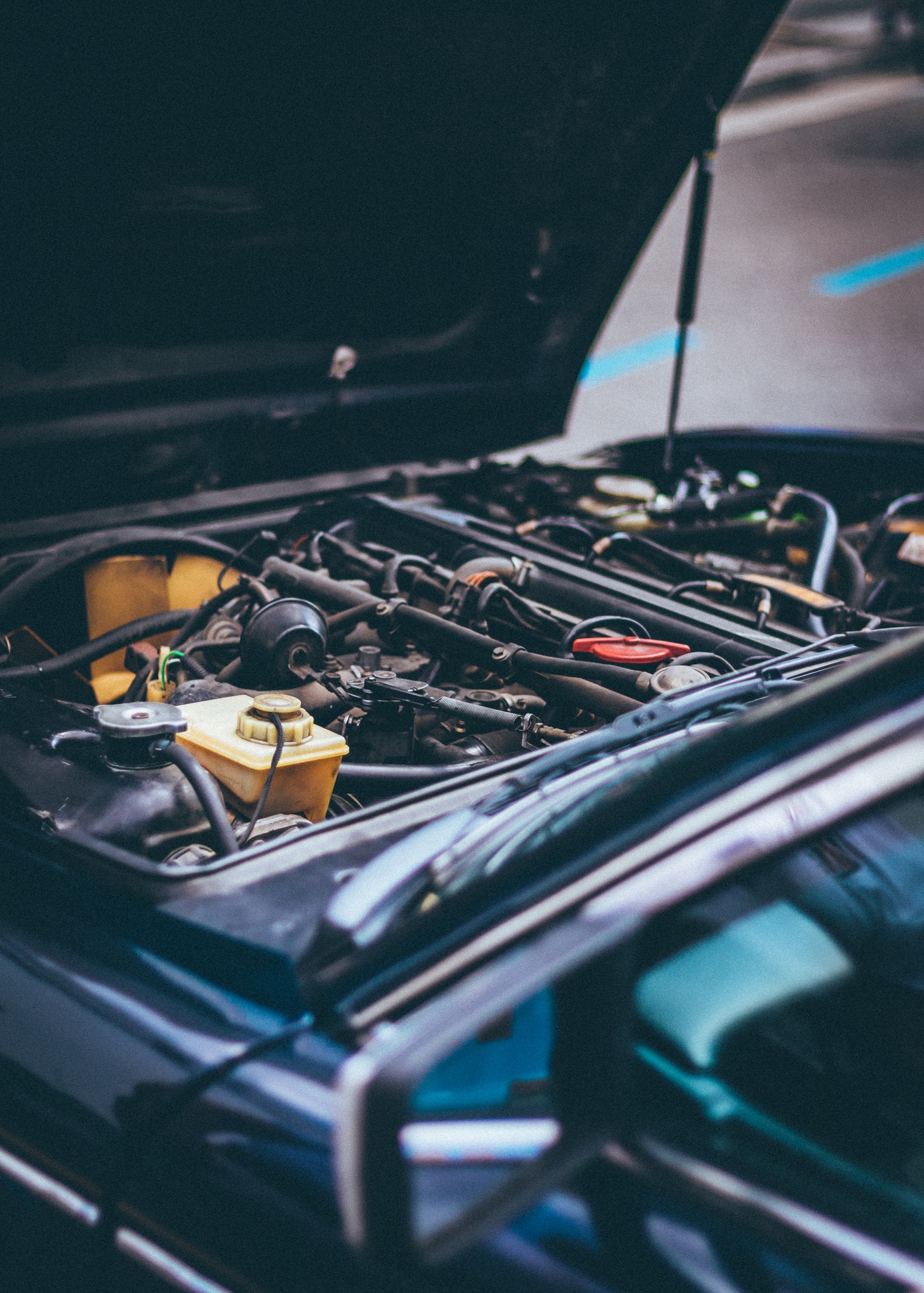

So, what can motor trader insurance offer those who repair vehicles?

Here are some elements of a typical policy:

Working on Vehicles

Repair garages need insurance cover for working on vehicles, as they can be held liable for any damages that occur while the car is in their possession and being worked on. This insurance coverage can protect the garage from any potential legal action and can also help to cover the cost of any repairs that need to be carried out because something went wrong.

Road Risks

If you’re a mechanic who needs to collect or return a customer’s car, it’s important to have the correct insurance in place. This will protect you in case something goes wrong while you have the car. Make sure you discuss your coverage with your insurance provider and ask about any restrictions or limitations that may apply.

Road cover can include:

- Third-party road use (as a legal requirement).

- The vehicle while being taken on a test run by the mechanic.

- Moving a vehicle from one location to another (at work premises).

- A customer’s vehicle in transit back to a customer while being driven by a representative of the garage. This might be a mechanic or a receptionist who has been added to the insurance.

Premises

Most mechanics will need to buy insurance for the premises or the garage where they carry out the repairs unless they are solely mobile mechanics. This is to have insurance for buildings and contents to protect them against any potential accidents, thefts, or damage that may occur while the work is being carried out or overnight.

Liabilities

Motor traders need to have liability insurance to protect themselves from any legal action that may come as a result of their business. The employer’s liability element is a standard part of most motor trader policies, and it can help to protect the business from claims where employees have sustained any kind of injury. Then, further protection can be had concerning customers and members of the public when public liability becomes part of a motor trader insurance policy too.

A motor trader policy is vital for any business that repairs vehicles. This type of insurance can protect the business from any potential legal action and can also help to cover the cost of any repairs that need to be carried out from unpredictable insured events and accidents.

When choosing a policy, it is important to consider the level of cover you need. You should also think about the excess you would need to pay in the event of a claim. These can be higher with motor trade insurances.

It is also important to shop around and compare different policies before you buy. This way, you can be sure you are getting the best deal for you.