As time moves, so should we. The world is undergoing digitization and improved technology on as many activities as possible. As a result of the same, people are moving to digital currencies and ditching fiat money. This is an arguable move as many do not trust digital technology due to loss. There are risks involved with our usual and traditional way of doing things but fear of the unknown prevents us from adopting new instruments. However, this does not mean that the digital way of life is bad or involves many risks. In most cases, technology and digitalization comes about to make it easier.

For instance, there were many critics that came with cryptocurrency but once people started investing in the digital assets and earning huge profits many other investors embraced the same as various countries across the globe encouraged the adaptability of the same to their citizens. When the digital trade began, the medium of exchange was Bitcoin. Other similar currencies for example Bitcoin Cash, Ethereum, Litecoin, Ripple, OmiseGo, Monera, NEO, and EOS. They are referred to as Altcoins. They all came about after Bitcoin had been established. This makes Bitcoin the dominant one in the industry. Many have predicted the overtaking of fiat money by Bitcoin as others argue against the same. This is because of how fast the cryptocurrency exchange market is expanding.

What is Bitcoin?

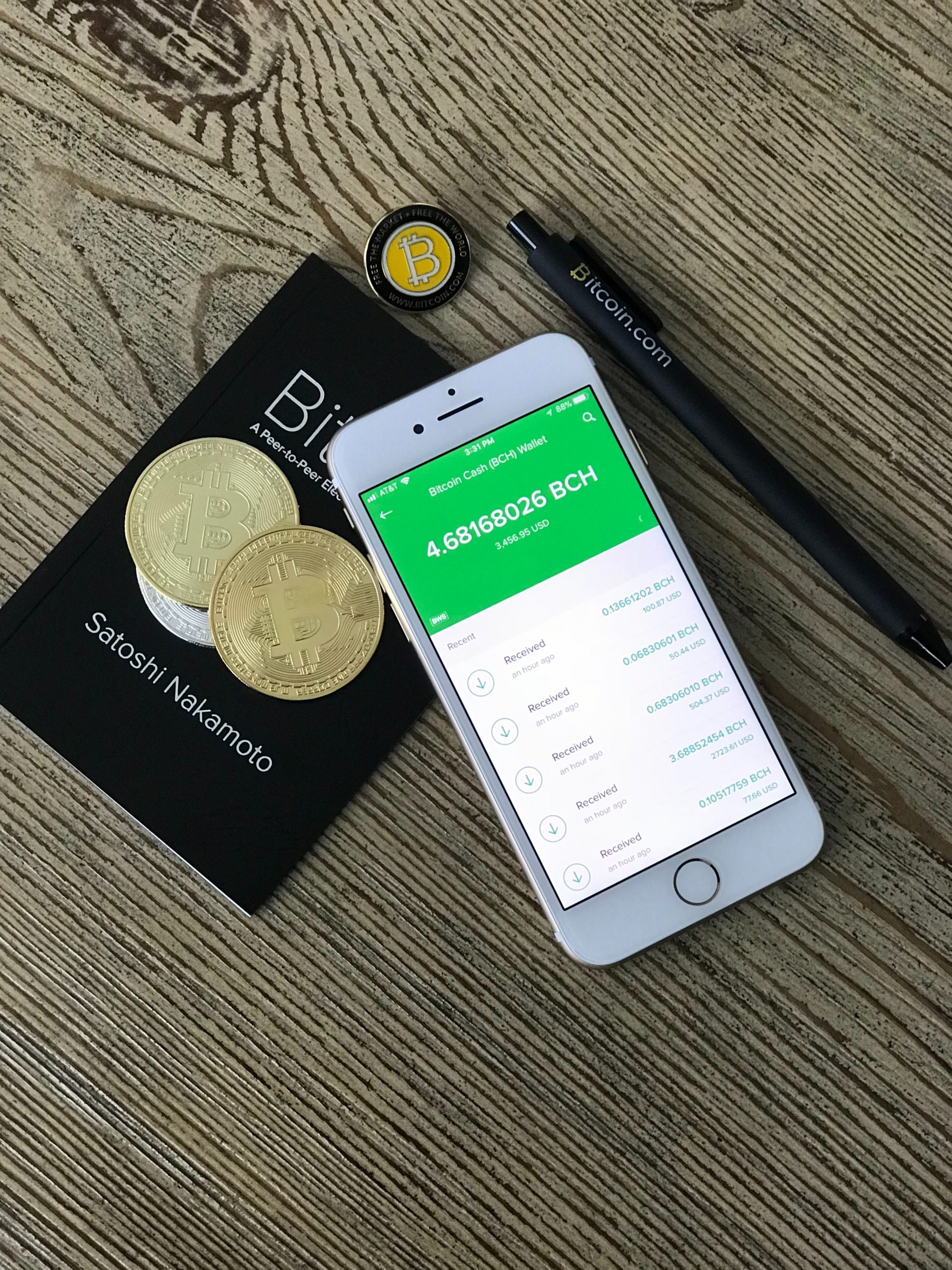

Bitcoin is a digital currency that was created in 2008 that is involved in digital trade and exchanges. It was brought about by Satoshi Nakamoto who is unknown to date. His idea was majorly boosted following the housing market crash in 2009. Since then, digital currency has spread far and wide as people make insane profits from its trade.

Bitcoin involves nodes that run and store Bitcoin’s blockchain which have the lists of transactions. This makes the system so secure as every transaction taking place in the Bitcoin’s market is indicated and information of the same availed to the investors and any other interested party. The cryptocurrency is operated and protected by a complex encryption algorithm.

How does Bitcoin work?

Bitcoin (BTC) operates on a peer-to-peer technology whereby the authority is decentralized to parties who are known as miners. Miners are independent parties who govern the computing power and network. They process transactions on the blockchain. Consequently, they are rewarded with the release of new bitcoin. The rate of the bitcoin reward varies from time to time.

The process of bitcoins being released for circulation is known as bitcoin mining. This can be done by coming up with new blocks which are added to the blockchain. One new block attracts a reward of 50 bitcoins. This has encouraged the fast spread of the cryptocurrency in various places in the world.

Many people across the globe have supported and encouraged investment on bitcoin. More people have endorsed it after they realized the amount of profits people are mining from digital investments. It is the best way to do trade without involving the central bank and the government all together. As a result of this, bitcoin is busy replacing the traditional exchanges and fiat money. Many people look for the cheapest way to buy bitcoin and exchange with it, choosing to invest in this currency over any others on the market. It could lead to uniformity of currency across the globe as it acts as an alternative to local currencies.

Adoption of Bitcoin

Adoption involves coming up with reasonable strategies that allow the use of digital currencies as an alternative method and removing barriers that hinder the same. Since bitcoin is not controlled by any government or Central Bank and it changes in value often, an adaptation of Bitcoin might be hard as the value keeps changing according to the market’s demand. The high demand has led to more people accepting it and incorporating it in trade as a means of exchange or a storage of value. Governments of different countries have promoted bitcoin by urging people to invest in the trade and use it in daily transactions. As many people are adapting digital assets and using them for activities like online shopping, the demand for bitcoin is going high. Leading to speculation of how people will sorely stick to digital assets in the future.

Bitcoin VS. Fiat money

On top of the list, bitcoin is more preferable than fiat money since Bitcoin does not involve the government or central bank. Their authority and operations are decentralized and the money is controlled away from financial institutions. Apart from that, Bitcoin has low transaction fees compared to traditional currencies for example when one is paying for online services. Additionally, Bitcoin has a ledger system that is created, distributed and stored in a decentralized way. This brings about transparency as information is shared to everyone who wishes to acquire it. This encourages investors in the trade as they know that there are no hidden fees and commissions calculated in the transactions.

The most important factor in finding the cheapest way to buy Bitcoin is yourself. You must be comfortable with an interface that may seem more complex, but if you want access and knowledge of this cryptocurrency then it will be worth all your time investment!

The next option on our list would have Binance as their cheap method because not only do they offer low rates for withdrawals or deposits (which means there are no hidden fees), but also provide clear instructions about how much money needs to be sent exactly each month according to too its price change around certain periods which has made trading easier than ever before – especially since many people don’t like watching charts 24/7 themselves; let alone know what day trader strategies work best when trying them.

Last but equally important, many prefer bitcoin as it is safer to trade compared to fiat money. Bitcoin provides two keys to the investors, the public keys, and the private keys. These are made with complex and encrypted mathematical algorithms. The public and private keys are a combination of numbers and letters which act as the account number and the individual account pin respectively. With these, more investors are attracted to digital currency and ditching the traditional fiat money. This shows a bright future for Bitcoin as more people are embracing and using it.

Cryptocurrencies have suffered a reputation nightmare especially in 2017 when new and naïve investors were manipulated by scrupulous hackers and it discouraged people from investing in the same. However, as the years passed by, the exchange of digital currencies has spread further. Automated platforms such as Bitcoin Digital App have encouraged newbies in the trade due to demo accounts and huge profits. Other platforms have preferred to use AI machines and robots in order to get rid of intermediaries who could see activities or information in your personal account, including the developers. These and more factors have led to more people in the cryptocurrency exchange trade. This is a clear indication and prediction that bitcoin might bring uniformity of currency by eliminating fiat money. This is the future!